New changes in the crypto power structure: Anchorage’s iron vault

More than a decade into the crypto boom, the era of fortunes made on Bitcoin’s four-year halving cycles has faded. Now, intermittent waves of liquidity from U.S. equities, the dollar, and Treasuries dominate, with each cycle defined by a series of distinct hotspots—mirrored in the trajectory of projects like Pendle, evolving from fixed income and LST to BTCFi, Ethena, and Boros.

It’s harder to create new capital than to manage established wealth.

As custodians say: profits follow the money.

In crypto, real capital is concentrated in three groups: individual whales (early BTC miners, early ETH investors, DeFi Summer OGs), on-chain institutions (crypto-native VCs, major CEXs and L1 blockchains, a handful of project teams), and the legacy and rising giants backed by Wall Street.

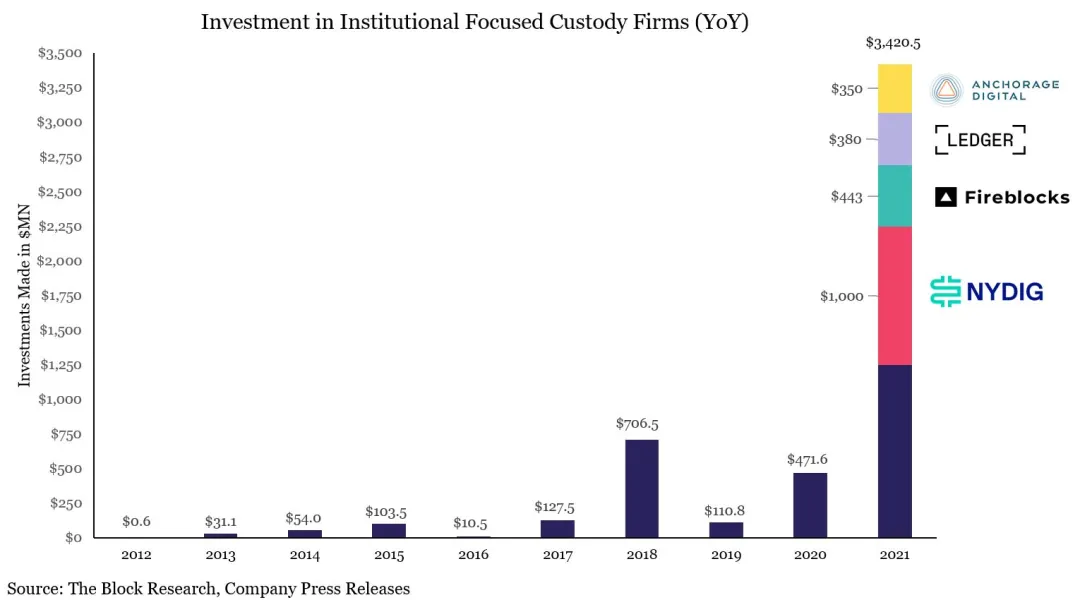

Image: Peak periods of custodian financing

Source: @zuoyeweb3

Custodians have become increasingly segmented. After raising $3 billion in 2021, and following the FTX-Celsius and 3AC-Luna-UST meltdowns in 2022, the crypto custody landscape has taken shape. For example:

- • On-chain project custody: Copper / Ceffu / Cobo

- • ETF custody: Coinbase

- • Bank-level: BNY Mellon

- • Exchange custody: Fireblocks

Coinbase, in particular, has captured almost the entire ETF custody market—over 80% of BTC and ETH ETF issuers work with them. MicroStrategy (MSTR) also selects Coinbase as its BTC custodian in treasury strategies.

The End of Retail Trading, The Dawn of Institutional Wealth Management

The ways to make money in crypto evolve with the era and scale of capital. Whoever controls the most capital earns the largest profits. Miners handed the baton to exchanges, then to market makers, and now to custodians, especially as traditional financial capital moves on-chain. These funds rarely enter public blockchains or exchanges directly; instead, they typically route through custodians.

Ethereum’s daily transactions have surpassed the DeFi Summer peak at 1.74 million, but this growth isn’t driven by memes or active trading. Instead, it’s the stablecoin loop lending kicked off by Aave and Ethena powering the momentum.

Likewise, Aave’s partnership with Plasma aims to bridge stablecoins from traditional finance to the blockchain. Yet under the Genius Act, payments-focused stablecoins can’t pay interest to users. Once capital lands on-chain, it becomes “dead weight” for issuers, with limited productive options.

Meanwhile, as overall CEX trading volumes shrink, the rise of custody, staking, and yield services is drawing attention from banks and TradFi. With expectations of rate cuts, channeling the liquidity of 401(k)s and treasury strategies to blockchain will open new entrepreneurial opportunities.

The exchange-dominated cycle is fading, squeezed by both on-chain solutions and the push for IPOs. Hyperliquid is showing signs of challenging Binance, while Kraken and Bullish compete to rival Coinbase as the only U.S.-listed exchange.

Strategically, everyone’s targeting post-CEX yield opportunities. For old money with deep pockets, lower yields are tolerable so long as principal is secure. Tether’s creation of its own physical gold vaults suggests that on-chain vaults could also become lucrative.

With ETFs setting the pace, Coinbase’s dominance is hard to shake. But the evolving landscape is opening new opportunities for second- and third-tier players.

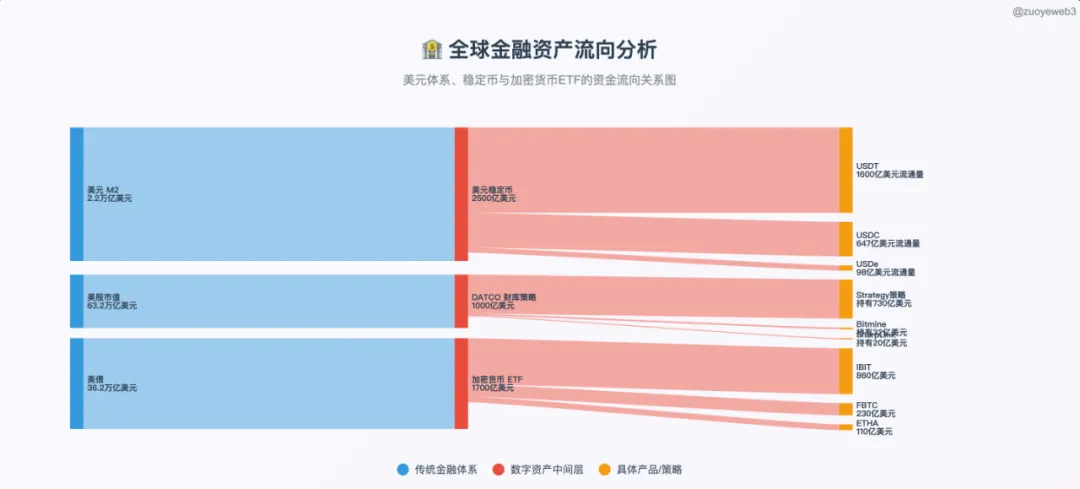

Image: TradFi & DeFi Integration

Source: @zuoyeweb3

Compared to the tidal wave of wealth in U.S. stocks, bonds, and dollars, crypto is still catching the runoff. Only with robust, secure infrastructure—a more substantial system, not a bucket—will meaningful liquidity truly flow.

Veteran market players are diverging, with Anchorage Digital and Galaxy Digital standing out as two sector leaders.

- • Treasury services (DATCO): Galaxy

- • Stablecoins: Anchorage

- • Emerging ETF staking: Anchorage Digital & Galaxy Digital

Beyond BTC and spot ETFs, both institutions share a goal: expanding their share of Coinbase’s custody market. Here’s where their strategies overlap.

The Spot ETF market is trending in two directions. First, generalization: altcoins and meme tokens (beyond BTC and ETH) listed as Coinbase derivatives for six months could soon be eligible for ETF conversion. Second, approval of Staking ETFs, allowing ETF issuers to redeem assets and connect directly to on-chain staking services.

One example: Anchorage Digital is the sole custodian and staking partner for the REX-Osprey Solana staking ETF, perfectly matching both trends. If the bull market continues, these ETF products will be key growth drivers for Anchorage Digital.

Anchorage also partners with 21Shares and BlackRock on traditional ETFs. Remarkably, it is now the custodian for the Bitcoin treasury of Trump Media Group, showing just how far Anchorage’s reach extends.

Anchorage: A Licensed Bank’s Stablecoin Blueprint and the Crypto Vault Dream

2019: Pursued a partnership with Visa; by 2021, became Visa’s USDC settlement bank.

2021: Launched crypto custody, reached a $3 billion valuation, obtained the OCC’s national crypto bank charter, and began serving as a digital asset custodian for the U.S. Marshals Service.

2022: Navigated the crypto crash, became Aptos’s primary custodian (co-founder Diogo Mónica is an Aptos investor).

2023: Platform assets rose 80% in Q1, but 75 staff (20%) were laid off; issued a call for stablecoin regulation.

2024: Co-founder Diogo Mónica exited operational management, with Nathan McCauley taking over fully.

2025: Anchorage Digital will custody Trump Media’s Bitcoin treasury and acquire USDM issuer Mountain Protocol.

Anchorage Digital, founded in 2017 by Nathan McCauley and Diogo Mónica, started as a small trust in South Dakota. In 2021, a stroke of luck enabled it to secure the OCC’s first and only national crypto bank charter—a unique edge to this day.

Exclusive financial services—whether in Silicon Valley, Wall Street, or Washington, D.C.—are ultimately about relationships.

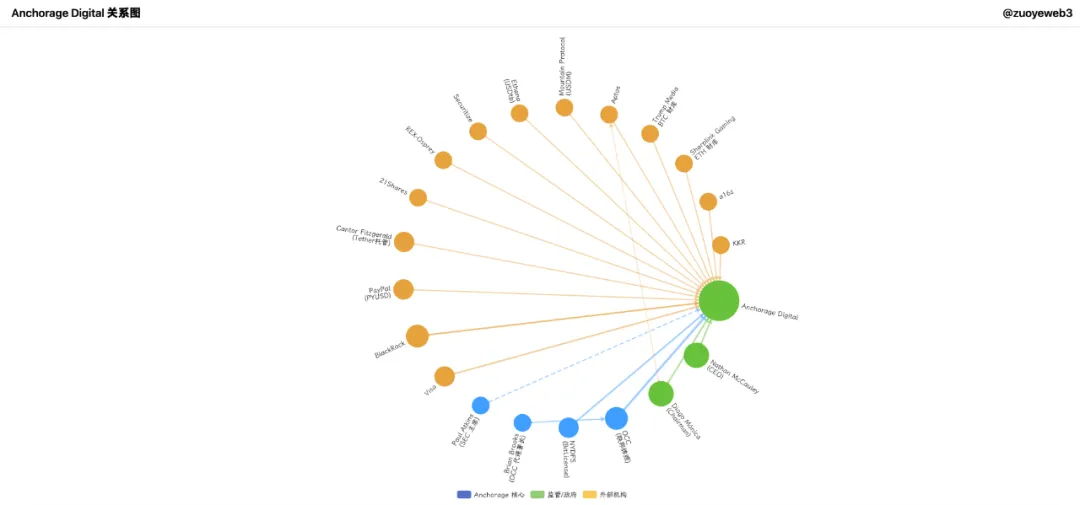

Image: Anchorage Digital’s Network

Source: @zuoyeweb3

Anchorage Digital has built a full suite of institutional services—trading, derivatives, clearing, staking, custody—positioning itself as an institutional one-stop shop. Unlike Galaxy, Anchorage is betting its future on stablecoins.

Which brings us to chapter one: in startups, timing is everything.

In 2021, Democrat Joe Biden—favoring tighter crypto regulation—took office. SBF was betting millions on Biden, hoping for a friendlier crypto climate. At the same time, former Coinbase general counsel Brian Brooks became acting OCC head.

Brooks was crypto-friendly, promoting bank access to crypto business via the REACh roundtable and urging fair treatment of crypto companies by banks.

Anchorage seized its moment, transforming from a small trust into Anchorage Digital Bank—the nation’s only such bank.

On January 13, 2021, Anchorage gained the right to accept USD deposits and provide crypto custody.

The next day, Brooks left office—leaving Anchorage Digital as the only licensed crypto bank in the U.S.

Today, Anchorage Digital showcases this regulatory credential on every platform; it enabled the company to raise $430 million in Series C and D rounds, supporting its push into the 2025 stablecoin mega-cycle.

Anchorage’s investors include crypto VCs like a16z and Wall Street titans like KKR and BlackRock.

Notably, Bitpay and Paxos also applied for charters but were denied; Paxos was recently fined $26.5 million by New York DFS for BUSD compliance issues.

Anchorage holds both a federal OCC charter and a New York BitLicense—second only to BNY Mellon in regulatory strength.

After Brooks’s departure, Anchorage clashed with the OCC but kept its coveted license, which continues to give the company a permanent edge.

Backed by this charter, Anchorage offers custody for everything from stablecoin reserves and crypto-assets to NFTs. Yet the 2022 crash led to internal turmoil, starting with disputes between founders.

Ultimately, Diogo Mónica joined Hanu Ventures as a partner, while remaining Anchorage Digital’s executive chairman (focused on strategy and hiring); Nathan McCauley took charge of daily operations and targeted BlackRock and the stablecoin vertical.

Anchorage is now custodian for the 21Shares Bitcoin and Ethereum Spot ETFs as well as the exclusive custodian and staking partner for the REX-Osprey Solana Staking ETF.

But outside ETFs, Anchorage Digital’s biggest wins are in stablecoins—partnering with Visa for stablecoin payments and onboarding compliant offerings like PayPal’s PYUSD for institutional clients.

Remarkably, Anchorage also works with Cantor Fitzgerald, the custodian and investor for Tether, to provide custody for Cantor’s Bitcoin business.

In other words, Anchorage is the custodian’s custodian for Tether.

Despite its regulatory clout, Anchorage didn’t stand out until 2025. With a $3 billion valuation and $50 billion under management, it still lagged Coinbase in ETFs. The real focus is the stablecoin segment.

Thanks to its federal license, Anchorage Digital Bank NA can accept both USD and stablecoin deposits and provide custody services.

- • Off-chain: Anchorage is expanding USDtb issuance with Ethena, bringing stablecoins into compliance under the Genius Act

- • On-chain: Anchorage, Paxos, and Kraken formed the USDG Stablecoin Alliance to operate the Global Dollar Network

On the treasury side, Anchorage isn’t idle: former BlackRock exec Joseph Chalom joined ETH treasury company Sharplink Gaming as co-CEO and helped to seal the BlackRock-Anchorage custody partnership.

In fact, BlackRock’s BUIDL fund relies heavily on Chalom; Anchorage is custodian, as the structure shows:

$BUIDL = BlackRock (issuer) = Securitize (tokenization platform) + Anchorage Digital (custody) + BNY Mellon (cash services)

Further, SEC Commissioner Paul Atkins holds at least $250,000 in Anchorage Digital equity and is also a Securitize shareholder; Securitize is Ethena’s partner for its Converage issuance.

With Galaxy Digital already public, speculation about an Anchorage IPO continues. The stablecoin business expansion requires capital, so we might soon see the first crypto bank IPO.

Galaxy Digital: Sitting on the Treasury Throne

Compared to Anchorage Digital, Galaxy stands out: it was the OTC partner for Goldman Sachs’ 2022 crypto pilot, the BTC off-ramp for whales, and it maintains broad exposure in BTC mining, investing, and AI infrastructure. Founder Mike Novogratz’s network is even wider than Anchorage Digital’s.

On July 25, Galaxy helped an early miner sell roughly 80,000 BTC ($9 billion); while the sale was staggered, the news still sent BTC down nearly 4% below $115,000.

There were suspicions of Galaxy manipulating the market, but it’s a pure institutional player, and institutional interests lie in stability and scale—not volatility. Real growth comes from low-risk, high-liquidity markets.

Galaxy’s real distinction is timing. Founder Mike Novogratz’s non-technical finance background frames his view of crypto as a capital opportunity, not a belief system.

Today, as retail exits and institutions enter, Galaxy’s expansion of treasury strategies deserves fresh focus.

Remember ETH treasury firm Sharplink, now led by a former BlackRock executive?

In June 2025, Sharplink repeatedly bought ETH via Galaxy OTC, totaling at least $800 million. Conveniently, Galaxy is a Sharplink investor: moving money internally.

Apart from BTC and ETFs, Galaxy also invests in Ethena’s StablecoinX Treasury and the $450 million Mill City Ventures III, Ltd. SUI treasury.

Galaxy’s OTC trading desk is expanding to support new asset types, like providing liquidity for LsETH from Liquid Collective; Liquid Collective’s institutional-targeted lsSOL product is supported by Anchorage Digital.

It’s a tightly connected world at the top.

Both Anchorage Digital and Galaxy Digital are part of the Global Dollar Network (GDN), highlighting that today’s custodian sector is more about collaboration than cutthroat competition.

Whereas Anchorage’s main growth avenue is stablecoins (thanks to its bank charter), Galaxy’s focus remains treasury strategy. The development of non-BTC/ETH treasuries is ongoing.

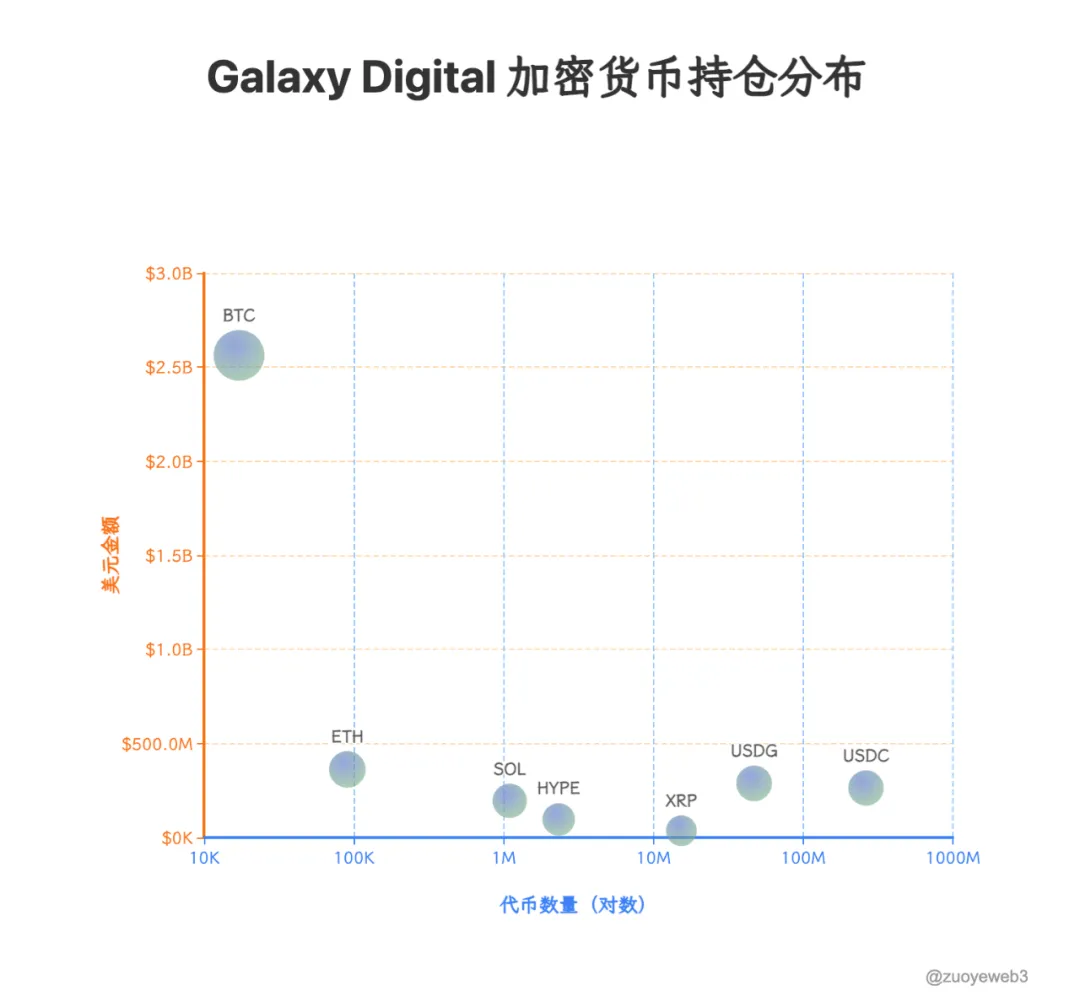

Galaxy leverages its balance sheet: holding $1.8 billion in BTC, it also strategically increased its XRP holdings by $34.4 million. Coincidentally, Ripple just paid $200 million to acquire Rail—Galaxy’s stablecoin portfolio company.

Again, moving money internally.

Galaxy’s filings point to the next treasury and market-making targets: $HYPE, $SOL, $XRP. With Ripple’s legal battle with the SEC resolved (and a 10% price jump that day), Galaxy has outpaced retail yet again.

Image: Galaxy Digital’s Portfolio Holdings

Source: @zuoyeweb3

Data: @SECGov

Galaxy has exited UNI and TIA; the new era leaves no room for yesterday’s elites. USDG, HYPE, and XRP are the new leaders, while OTC trading desks always sense the first ripples of market change.

Traditionally, OTC trading desks simply executed whale trades without affecting the secondary market—unlike market makers at exchanges. But treasury strategy will change everything: coins, stocks, and bonds will be issued in tandem, and who sets the price remains to be seen.

Conclusion

Custodians are now the nexus of capital flows. Off-chain assets require secure on-chain solutions; on-chain assets need compliant off-ramps. Treasury strategies will empower custodians to actively shape token prices. Crypto liquidity is the new axis of market power—long the domain of CEXs and market makers, but their glory days are over.

BNY Mellon manages over $52 trillion in assets. By contrast, total crypto market cap is under $4 trillion, and the combined value of USD stablecoins, crypto ETFs, and treasury firms sits at just $520 billion. Crypto custody’s market influence will take time to mature.

But wherever the money goes is where the real profits lie—a point every founder should consider seriously.

Disclaimer:

- This article is republished from [Zuoye Wai Bo Shu]. Copyright belongs to the original author [Zuoye Wai Bo Shu]. If you have any objection to this republication, please contact the Gate Learn team. We will address the issue promptly as per applicable procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is explicitly credited, do not copy, distribute, or plagiarize these translated versions.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge