IncomeSharks

No content yet

IncomeSharks

I think my biggest mistake on this trade wasn't getting in too early. I think it's having too low of targets of when to exit. Removed my $3,600 target already, might do the same with $4,000 depending on the reaction there.

EARLY-55.2%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- 1

- Comment

- Share

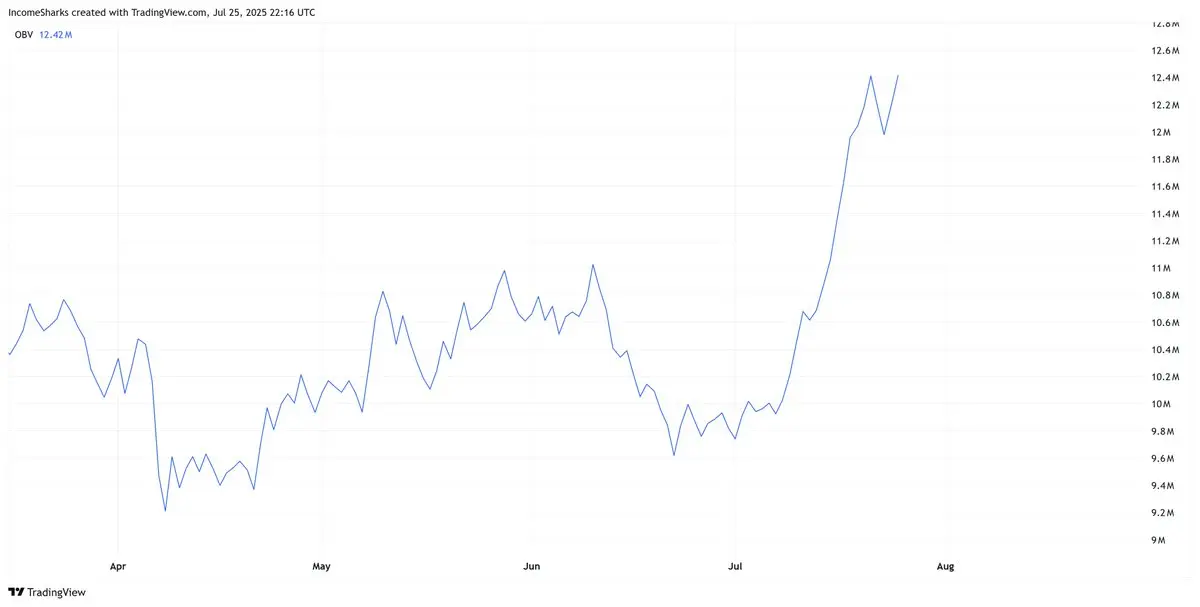

In the past 25 days we've only see 4 red daily candles for Ethereum. And the candles have been TINY. This is some of the best momentum we've seen in a long time.

ETH-1.09%

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- 1

- Share

Harrio4life :

:

Pump, you better make move...- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

There was 750 billion dollars added to crypto in the month of July. We'll see at least see 4 to 5 trillion marketcap in the next few months.

LL-1.96%

- Reward

- like

- Comment

- Share

- Reward

- like

- 1

- Share

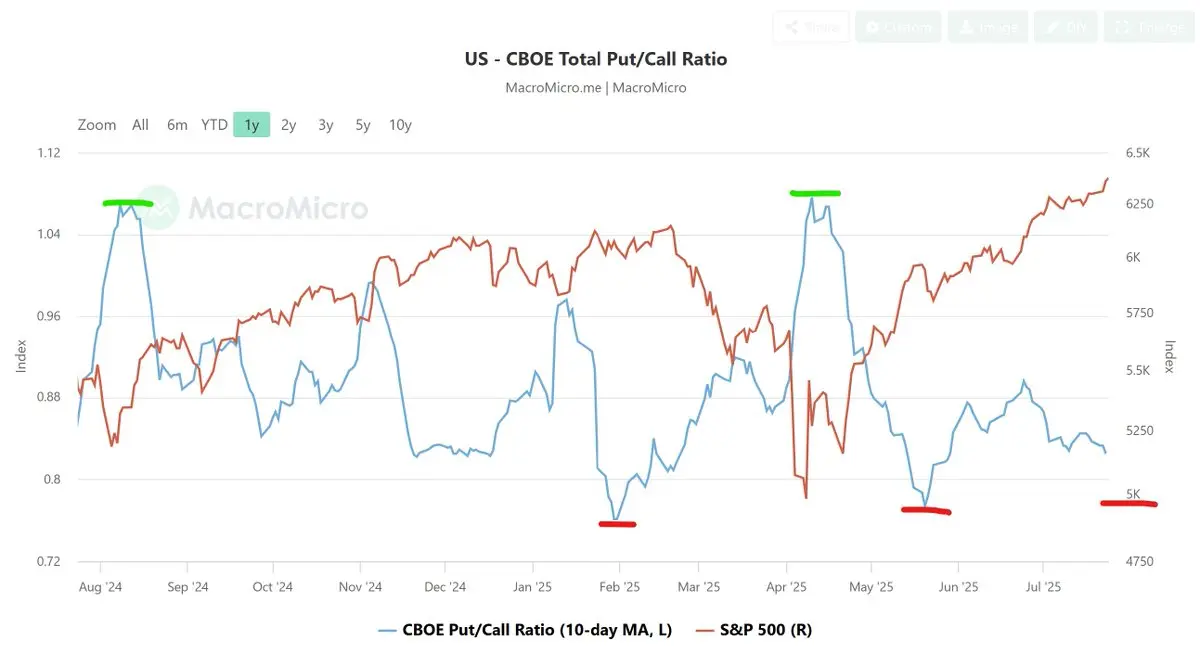

ReadyToExitTheCircle :

:

When everyone is bullish, the big risks are coming.$ETH - After a record setting 9 daily candles, two tiny red candles, we are now back to already 2 green candles. Some of the most bullish action we've seen in years. Still time to hit $4k before end of month.

ETH-1.09%

- Reward

- like

- Comment

- Share

- Reward

- 1

- 1

- Share

GateUser-5727aeae :

:

Just go for it 💪- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share

- Reward

- like

- Comment

- Share